Hedge Fund Outperformance

IBKR Hedge Fund Clients Outperformed the Market in 2025

A prime brokerage platform designed for performance-driven hedge funds.

IBKR Hedge Fund Clients

S&P 500 Index

IBKR returns are net of commissions and charges.

Cost Efficiency That Compounds

Low commissions, transparent loan and borrow rates, and efficient securities lending reduce structural drag on performance.

Tiered, Institutional Pricing

Stock/ETF commissions from

USD 0.0005 - 0.0035 per share

Options commissions from

USD 0.15 - 0.65 per contract

Financing and Securities Lending

Margin rates as low as

USD 4.14%

Integrated securities lending and borrowing with transparent short availability and borrow rates, supporting short selling and portfolio financing

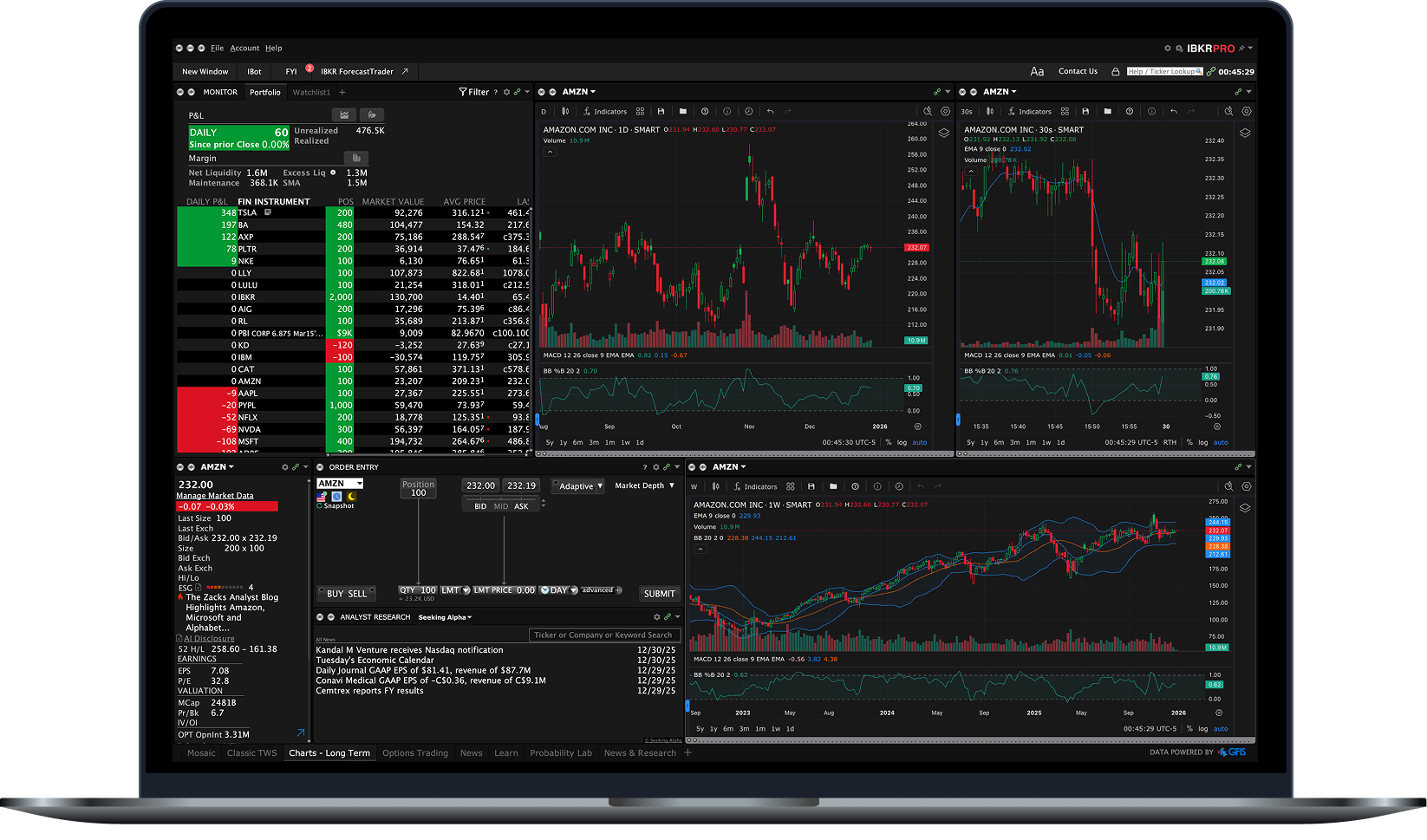

Execution and Trading Technology

Institutional Trading Platforms

Built for Active Funds

Professional trading platforms, advanced order types, APIs, and institutional tools designed to support complex strategies, execution control, and disciplined risk management across global markets.

Best Execution Through Smart Routing

IBKR SmartRoutingSM dynamically seeks the best available prices across multiple venues, helping minimize market impact and support best execution across asset classes and regions.

Integrated Risk Analytics

Understand risk and return with real-time monitoring that measures portfolio-wide exposure across global asset classes.

View Our Award-Winning Trading Platforms

Products

Access 170+ Markets in One Platform

Financial Strength

A Prime Broker You Can Trust

IBKR’s automated, real-time risk management, conservative capital structure, and long operating history matter to funds managing leverage and client capital. Strong controls reduce counterparty and operational risk while enabling scale.

Trusted by over

4 Million

clients worldwide

Executing more than

3.5 Million

trades daily

Nasdaq-listed

IBKR

Member of the

S&P500

Client assets over

$750 Billion

Total Equity

$19.5 Billion

Nearly

50 Years

of Innovation

Ready to Upgrade Your Prime Broker?

Looking for additional details on IBKR's hedge fund prime brokerage services?

Disclosures

- Past performance is not indicative of future results. Returns shown are based on aggregate data for Interactive Brokers accounts meeting minimum thresholds as of January 1, 2025 ($50,000 for individual and advisor accounts and $1,000,000 for hedge fund accounts), inclusive of all commissions and charges. Results may vary significantly among clients. Comparisons to the S&P 500 are for informational purposes only. Investing involves risk, including the potential loss of principal.

- Supporting documentation for any claims and statistical information will be provided upon request.

- For complete information, see our margin rate comparison.

- Interactive Brokers Group and its affiliates. For additional information view our Investor Relations - Earnings Release section.