Products Stock Trading

PRODUCTS

Trade Stocks Globally from a

Single Screen

The IBKR Advantage

- Low commissions with no added spreads, ticket charges, platform fees, or account minimums

- Trade stocks globally on 90+ market centers

- Lowest financing rates in the industry

- Professional trading platforms, mobile apps, order types, and tools

- Transparent shortable inventory and pricing

- Fractional Shares let you invest regardless of share price

- Earn extra income on your fully paid shares

Zero Commission Isn't the Same as Free

Interactive Brokers clients receive significant savings vs. other brokers

Comparison of US Stock Trading Costs for Canadian Residents

The comparison to other providers is based on the rates published on their websites as of February 10, 2025 for deals in US stocks. Deals in U.S. listed ETFs and U.S. dollar-traded Canadian ETFs not considered. Providers' account types used for this illustration are what we consider default standard tier. 1

See Notes and Disclaimers for complete information.

| Total Trade Cost with Currency Conversion2,3 | Advertised Rates | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Broker | 50 shares CAD 2,000 |

100 shares CAD 5,000 |

200 shares CAD 10,000 |

US Stock Commission |

FX Conversion Fee4,5 |

||||||||||||||||||||||||

| Interactive Brokers | USD 2.527 | USD 2.707 | USD 3.407 | USD 0.00356 | USD 2.006 | ||||||||||||||||||||||||

| WealthSimple | USD 23.588 | USD 58.958 | USD 58.958 | USD 0.00 | 1.50%8 | ||||||||||||||||||||||||

| Questrade | USD 23.589 | USD 58.959 | USD 117.909 | USD 0.0011 | 1.50%12 | ||||||||||||||||||||||||

| BMO Investorline | USD 35.1010 | USD 72.8310 | USD 135.7110 | USD 9.95 | 1.60%13 | ||||||||||||||||||||||||

|

Cannot be determined because we have not been able to locate the foreign exchange conversion fee on the pricing pages of the public website of these providers. |

|

|||||||||||||||||||||||||||

- The comparison is based on our understanding of the other providers' published rates available on their websites as of February 10, 2025. The comparison is also based on the quantity of shares comprising the trade sizes in the three scenarios displayed above. WARNING - The comparison of brokerage fees that are set under different pricing models may vary based on the quantity of shares comprising the trade and in some cases, a fixed or "per-trade" fee pricing model (as used by other providers) can, in fact, be more competitive that Interactive Brokers' variable or "per-share" pricing model which is more competitive when the trade size is comprised of a smaller quantity of shares. For example, our commission on a trade size of USD 20 000 will be USD 1.75, when the trade is for 500 shares at USD 40 but will be USD 17.50 when the trade is for 5000 shares at USD 4.00 ([0.0035 x 500 shares = USD 1.75] and [0.0035 x 5000 shares = USD 17.50]).

- "Total Trade Cost with Currency Conversion" considers stock execution commission (when applicable) and fx conversion fee charged by the providers. In case of IBKR, we have additionally included regulatory, clearing and exchange fees that are passed through to the client on a transactional basis.

- Assuming account initially funded with, and holding, Canadian currency (CAD). This table shows three different trade sizes using different quantity of shares traded on a U.S. market. For comparison purposes, "Total Trade Cost with Currency Conversion" is indicated in USD. The USD/CAD FX exchange rate used in the comparison table is 1.2722, which conversely represents a rate of 0.7860 CAD/USD (used for calculation purposes).

- This conversion fee is the revenue earned by the broker on each currency conversion transaction. It is an additional fee to the commission or other fees applicable to the stock transaction. For the purpose of this presentation the foreign exchange conversion fee is expressed as a percentage of the total value of the currency being converted. For the other providers in this table, this fee is typically included in the total foreign exchange rate applied to the conversion without charging a separate transaction-based "commission". Although the total foreign exchange rate applied to the conversion is usually disclosed to clients at the time of the currency conversion transaction, the conversion fee applied to the conversion is rarely disclosed separately to the client. In the interest of providing a transparent pricing structure, IBKR does not mark up its FX quotes and therefore does not include a conversion fee in the total foreign exchange rate applied to the conversion. Instead IBKR passes through the prices that it receives from the global interbank market and charges a separate FX "commission" which is clearly disclosed to clients at the time of the currency conversion.

- Some firms may not allow you to hold U.S. dollars in your brokerage account and will subject you to forced currency conversion fees on each transaction.

- IBKR tiered stock commissions of USD 0.0035 per share (minimum of USD 0.35). Other providers' stock commissions are usually set at a dollar amount per trade basis. IBKR's FX "commission" of USD 2.00 per order (0.20 basis point x trade value, with a minimum of USD 2.00 per order). Note- One basis point = 1/100 of 1%, so 0.20 basis point = 0.002%

- IBKR Total Trade Cost with Currency Conversion = IBKR Tiered Stock Commissions + Exchange, Regulatory, Clearing Fees + FX "Commission".

USD 2.52 = 0.35 + 0.17 + 2.00; USD 2.70 = 0.35 + 0.35 + 2.00; USD 3.40 = 0.70 + 0.70 + 2.00 - Wealthsimple FX Conversion fee is 1.5% for amounts between $0-$9,999.99 and 0.75% for amounts between $10,000-$24,999.99

Wealthsimple Total Trade Cost with Currency Conversion = Zero Stock Commission + FX Conversion Fee.

USD 23.58 = 0.00 + (CAD 2000 x 0.7860 x 0.0150); USD 58.95 = 0.00 + (CAD 5000 x 0.7860 x 0.0150); USD 58.95 = 0.00 + (CAD 10,000 x 0.7860 x 0.0075) - Questrade Total Trade Cost with Currency Conversion = Stock Commission + FX Conversion Fee.

USD 23.58 =0.00 + (CAD 2000 x 0.7860 x 0.0150); USD 58.95= 0.00 + (CAD 5000 x 0.7860 x 0.0150); USD 117.90 = 0.00 + (CAD 10,000 x 0.7860 x 0.0150) - BMO Investorline Total Trade Cost with Currency Conversion = Stock Commission + FX Conversion Fee.

USD 35.10 = 9.95 + (CAD 2000 x 0.7860 x 0.0160); USD 72.83 = 9.95 + (CAD 5000 x 0.7860 x 0.0160); USD 135.71 = 9.95 + (CAD 10,000 x 0.7860 x 0.0160) - Exchange and ECN fees may apply.

- As published on https://www.questrade.com/pricing/self-directed-commissions-plans-fees#fees

- For transaction size less than $25,000 CAD.

- The Securities and Exchange Commission (SEC) charges a fee for every executed sell order on any American exchange. Desjardins Online Brokerage reserves the right to limit the number of intra-session trades on the same security.

- Trades must have been made through National Bank Discount Brokerage's electronic solutions.

- We have not been able to locate on the pricing pages of the public website of these providers the foreign exchange conversion fee component of the foreign exchange conversion rate applied to a specific currency conversion transaction.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up, and you may get back less than you invest.

Lower Costs to Maximize Returns1

Stocks Commissions

Low Commissions

USD 0.0005 to USD 0.0035 per share

Lowest Financing Rates in the Industry2

4.14% - 5.14%

Interest Charged for Margin Loans

Earn interest at competitive rates3

Up to USD 3.14%

on instantly available cash

Trading Technology

- Free Access to all IBKR's trading platforms

- Free real-time streaming data on all US-listed stocks

- IB SmartRoutingSM

- IBKR APIs

Additional Plan Benefits

- No minimums for general investment accounts

- No inactivity fees

- No added spreads, ticket charges or platform fees

- No recurring fees

IB SmartRoutingSM helps support best execution by searching for the best available prices for stocks, options and combinations across exchanges and dark pools.

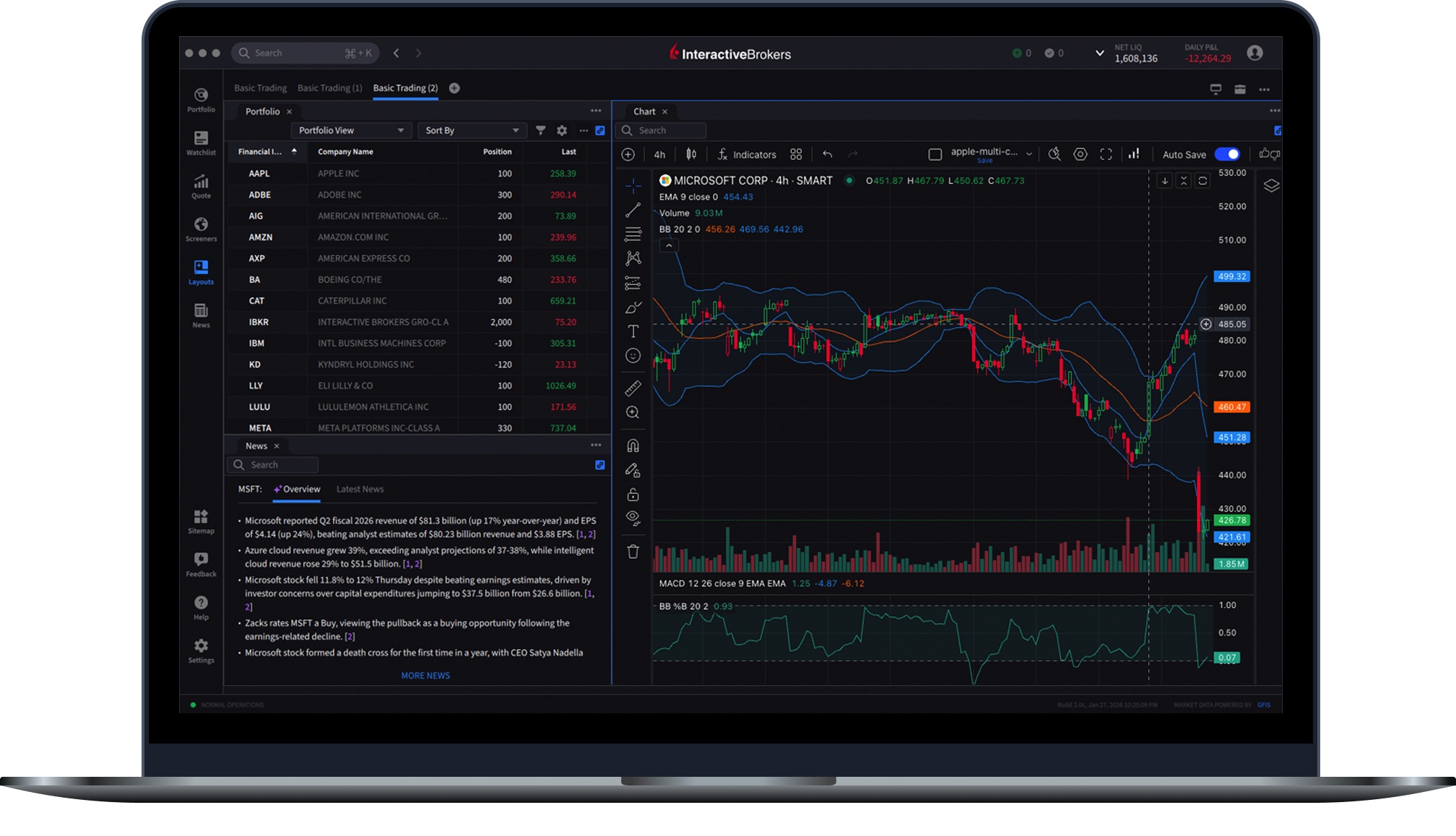

Professional Trading Platforms, Order Types, and Tools

Powerful, award-winning trading platforms and tools for managing your portfolio. Available on desktop, mobile apps, and web.

See Our Trading Platforms100+ order types, algos and tools – from limit orders to complex algorithmic trading – help you execute any trading strategy.

See Our Order Types, Algos and ToolsUse a full suite of professional trading tools to help make better decisions and manage your portfolio. Spot market opportunities with Advanced Market Scanners and analyze your portfolio with Risk Navigator.

See Our Trading ToolsFundamentals Explorer provides comprehensive, worldwide fundamentals data on over 30k companies, shows more than 300 data points per company, has more than 80 sources for newswires and reports and features 5.5k+ analyst ratings from TipRanks.

See Our Fundamentals ExplorerAlign your investments with what you care about most. Use the Impact Dashboard to identify and invest in companies that share your values, and use ESG scores from LSEG to make investment decisions based on more than just financial factors.

Learn About Sustainable Investing

Transparent Shortable Inventory and Pricing

The Shortable Instruments (SLB) Search tool is a fully electronic, self service utility that lets you search for availability of shortable securities from within Client Portal.

Learn About Short Securities Availability

Earn Extra Income on Your

Fully Paid Shares

Earn extra income on your fully paid shares. IBKR borrows your shares to lend to traders who want to short and are willing to pay interest to borrow the shares. You are paid interest each day shares are on loan and retain the ability to trade your loaned stock without restrictions.

What are Stocks?

A stock represents ownership in a company. When you purchase a stock, you become a shareholder and own a small portion of the company issuing the stock. Therefore, you have a claim on its assets and earnings.

A company typically issues stock to raise capital to fund growth, research and development, or its operations without taking on debt.

The two main types of stock are common stock, which typically provides you with voting rights and potential dividends, and preferred stock, which usually provides fixed dividends and priority over common shareholders in the unlikely event of a liquidation.

How Do You Buy Stocks?

You can purchase stocks through an online brokerage account like those available at Interactive Brokers or through a financial advisor. If you use an online brokerage account, you can place buy or sell orders for stock through the broker’s platform after your account is approved and funded.

Stocks are bought and sold at a stock exchange, such as the New York Stock Exchange (NYSE), the NASDAQ, the London Stock Exchange (LSE), Euronext or the Shanghai Stock Exchange.

What Are the Risks and Rewards of Stocks?

A stock’s price can be volatile, meaning the value of your stock may rise or fall significantly, even over short periods. There are no guarantees in stock investing. You may lose money if the price of a stock drops below your purchase price and you sell at a loss. In addition, you can also experience losses from a company’s bankruptcy, poor earnings or broader market factors such as industry or economic trends, interest rate changes, geopolitical events or investor sentiment.

However, if a stock’s price increases over time, you may benefit from capital appreciation and earn dividend income from companies that share profits with their owners. Dividends can provide a steady income stream and, if reinvested, may help you enhance longer-term returns.

Interactive Brokers’ Education and Resources for Stocks

Traders’ Academy

Traders’ Academy by Interactive Brokers provides complimentary resources to educate you on stocks, including several courses on corporate stocks and equity-related funds.

Traders’ Insight

Traders’ Insight provides market-related articles and commentary from Interactive Brokers’ employees, exchanges and third-party contributors.

Start trading like a professional today!

Open AccountDisclosures

- Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

- According to StockBrokers.com Interactive Brokers Review: Read the full article Online Broker Reviews, January 28, 2026. "The industry’s cost leader: Interactive Brokers continues to set the benchmark for cost efficiency, offering margin rates and high yields on idle cash that consistently outperform the competition." View our margin rates for more information.

- Rates are subject to change. Restrictions apply. For additional information, see our interest rates. Credit interest rate as of February 4, 2026 .

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and Member - Canadian Investor Protection Fund. Know Your Advisor: View the CIRO AdvisorReport. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities or derivatives. Our registered office is located at 1800 McGill College Avenue, Suite 2106, Montreal, Quebec, H3A 3J6, Canada.

Know Your Advisor: View the CIRO AdvisorReport