Interactive Brokers Careers and Job Openings

We use advanced trading technology to transform investing and empower more than four million clients worldwide to trade globally.

Innovators Wanted

We are looking for people who see opportunity where others see the status quo. At Interactive Brokers, every one of our exceptional and dedicated employees plays a role in keeping our technology on the cutting-edge, and our company at the forefront of the electronic trading industry.

Our employees work on projects that impact clients around the world in a dynamic startup-style culture. We offer opportunities to push the boundaries of technology. Why will you choose Interactive Brokers?

Keys to a Successful Career (Part 1)

Keys to a Successful Career (Part 2)

Our Projects

Our teams take pride in building our technology.

Learn more about some of our recent projects below.

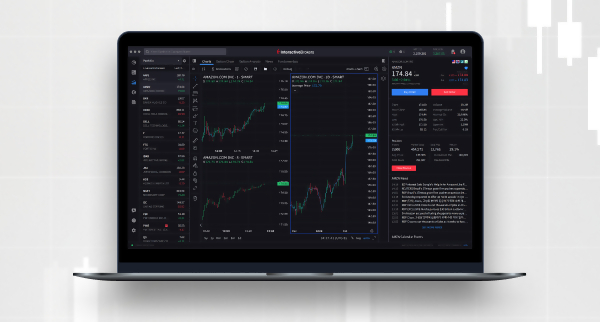

IBKR Desktop

Our newest client-driven desktop trading platform combines the most popular tools from our flagship Trader Workstation (TWS) with a growing suite of original features suggested by our clients.

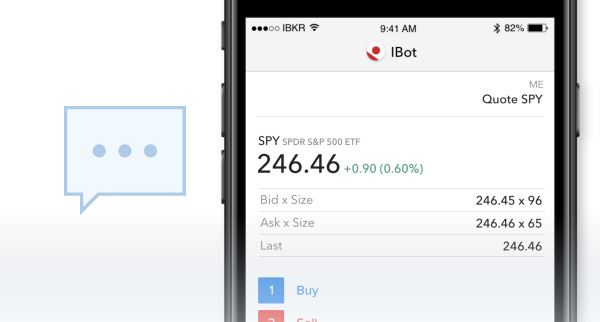

IBot

We have combined Machine Learning and Artificial Intelligence so you can trade using natural language commands.

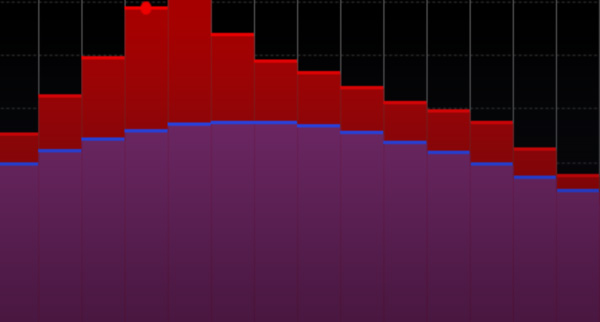

Probability Lab

We made it easy to trade options without the complicated mathematics using our Probability Lab (patent pending).

IB Adaptive Algos

Using our knowledge of markets, we created an order type designed to save clients' money by dynamically adapting to changing conditions.

Split Spread

Our trading tools make it easy to enter orders within the spread, allowing clients to gain price improvement on their orders.

PortfolioAnalyst

We re-engineered our popular portfolio analysis and reporting tool with a sleek, easy-to-use interface, and added more features. Available on any desktop or mobile device.

CRM

Advisors and brokers use our database-driven CRM to manage the entire customer relationship life cycle, from contact to prospect to client, in one place.

IBKR GlobalTrader

Easily trade global stocks, options and ETFs from your iOS or Android device (tablet or smartphone).

Our Business

For over 40 years, Interactive Brokers has been the pioneer of the electronic trading revolution. We rapidly scaled from a small U.S. options market-maker into a sizable global trading firm by leveraging the power of technology and automation.

Recognizing an opportunity to provide low-cost brokerage services to individuals and institutions seeking alternatives to high-priced firms, we opened our vast intercontinental electronic network and trade execution services to clients. Today, we serve 4.40M clients in over 200 countries and territories worldwide.*

Since inception, we have been committed to delivering value through technological innovation, and providing our clients with unprecedented access to global markets at the lowest cost.

IBKR News

February |Bloomberg TV

S&P Poised for Biggest Advance Since May | The Close 2/6/2026

Interactive Brokers' Founder and Chairman Thomas Peterffy joins Bloomberg TV's "The Close" to discuss the rise in forecast contacts (his comments start at the 24:45 mark).

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and a member of the Canadian Investor Protection Fund. Know Your Advisor: View the CIRO Advisor Report. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide suitability determination services nor investment advice or recommendations regarding the purchase or sale of any securities or derivatives.

Product availability varies depending on the country of residence and the Interactive Brokers affiliate.

January |Barron's

Interactive Brokers Earnings Beat Wall Street Estimates Amid Investor Trading Surge

Barron's reports on IBKR's latest earnings.

Product availability varies depending on the country of residence and the Interactive Brokers affiliate.

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and a member of the Canadian Investor Protection Fund. Know Your Advisor: View the CIRO Advisor Report. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide suitability determination services nor investment advice or recommendations regarding the purchase or sale of any securities or derivatives.

January |CNBC

Interactive Brokers' Thomas Peterffy talks quarterly results ahead of investors call

Interactive Brokers' Founder and Chairman Thomas Peterffy joins 'Closing Bell Overtime' to talk about IBKR's latest earnings.

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and a member of the Canadian Investor Protection Fund. Know Your Advisor: View the CIRO Advisor Report. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide suitability determination services nor investment advice or recommendations regarding the purchase or sale of any securities or derivatives.

January |Ausbiz TV

AI is changing the game & the smart money is already using it to trade smarter, not harder..." Peterffy

Interactive Brokers' Founder and Chairman Thomas Peterffy joins Ausbiz TV to discuss IBKR clients outperforming the market among other market trends.

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and a member of the Canadian Investor Protection Fund. Know Your Advisor: View the CIRO Advisor Report. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide suitability determination services nor investment advice or recommendations regarding the purchase or sale of any securities or derivatives.

January |Reuters

Interactive Brokers says betting on US midterm elections should juice growth of its platform

Interactive Brokers says betting on US midterm elections should juice growth of its platform.

Product availability varies depending on the country of residence and the Interactive Brokers affiliate.

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and a member of the Canadian Investor Protection Fund. Know Your Advisor: View the CIRO Advisor Report. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide suitability determination services nor investment advice or recommendations regarding the purchase or sale of any securities or derivatives.

January |CNBC

Interactive Brokers' Thomas Peterffy joins the prediction market debate

Interactive Brokers' Founder and Chairman Thomas Peterffy discusses forecast contracts with CNBC's "Halftime Report."

Product availability varies depending on the country of residence and the Interactive Brokers affiliate.

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and a member of the Canadian Investor Protection Fund. Know Your Advisor: View the CIRO Advisor Report. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide suitability determination services nor investment advice or recommendations regarding the purchase or sale of any securities or derivatives.

Disclosure

Links posted to the “IBKR in the News” webpage are published by third parties and not by Interactive Brokers. These third-party sources are independent and Interactive Brokers does not make any representations or warranties concerning the accuracy of the information provided by these third parties. By linking to third-party websites, Interactive is not recommending that you subscribe to that particular news source.

Interactive Brokers in the News

NPR's Planet Money Interview with Thomas Peterffy

Our CEO Thomas Peterffy, considered "the father of high speed trading" and a truly great innovator, explains how our company was born out of a single great idea.

Award Winning Platform & Services

#1 Professional Trading

#1 International Trading

Best Online Broker,

for Advanced Traders

Best for

Advanced Traders

Best Online Broker

Why Develop at

Interactive Brokers

Our unique culture and structure enable our employees to continue to push the boundaries of technology to drive our business forward. We empower our employees to work on the best ideas and we don't let bureaucracy get in the way of innovation.

If you like the thought of working for the firm that facilitates more trades than any broker in the world but still fosters the atmosphere of an energetic start-up, find your role at Interactive Brokers today.

Interactive Brokers Facts:

IBKR

TICKER SYMBOL ON

NASDAQ

$20.5B

EQUITY CAPITAL*

4.40M

NUMBER OF CLIENT

ACCOUNTS*

32%

YEAR OVER YEAR GROWTH

IN ACCOUNTS*

3,180+

NUMBER OF

EMPLOYEES

28

OFFICES THROUGHOUT

THE WORLD

Locations

We are a global company headquartered in Greenwich, Connecticut, with 3,180+ employees in offices in the USA, Canada, UK, Ireland, Hungary, Switzerland, Estonia, Russia, UAE, India, China (Hong Kong and Shanghai), Japan, Singapore, and Australia.

ChicagoIllinois

West Palm BeachFlorida

WashingtonD.C.

GreenwichConnecticut

MontrealCanada

LondonEngland

ZugSwitzerland

TallinnEstonia

MumbaiIndia

Hong KongChina

TokyoJapan

SydneyAustralia

Budapest Hungary

St. Petersburg Russia

NYCNew York

VancouverCanada

ShanghaiChina

Fort LauderdaleFlorida

DublinIreland

Singapore

TorontoCanada

HyderabadIndia

BostonMassachusetts

PetalumaCalifornia

DubaiUnited Arab Emirates

Locations

We are a global company headquartered in Greenwich, Connecticut, with 3,180+ employees in offices in the USA, Canada, UK, Ireland, Hungary, Switzerland, Estonia, Russia, UAE, India, China (Hong Kong and Shanghai), Japan, Singapore, and Australia.

Benefits and Incentives

As an employee of Interactive Brokers, you will enjoy a competitive and comprehensive benefits and compensation package. While the specifics of each country's package may vary, most of our offices offer some version of the following, plus more:

Competitive Pay with discretionary bonus packages which may include company stock grants

Comprehensive Health Plans that include extensive Vision, Dental and Prescription coverage

401K Retirement Savings Plan (generous company match)

Daily Lunch Allowance

Wellness Incentives

Flexible Spending Accounts

Paid Personal Time and Sick Leave

Sustainability

Check out our Sustainability Initiatives

Use your skills and interests to

innovate at Interactive Brokers.

Review our many openings across our unique teams

and see what opportunities are right for you.

*Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section.

HR Statement

IBKR is committed to security and privacy, not just for our employees and clients but also for potential candidates seeking employment at IBKR.

It is important to note when communicating with recruiters or hiring managers:

- All candidates will be asked to apply through our career site or 3rd party site that will direct your application to our career site.

- Candidates deemed qualified and moved to the interview stage will be asked to do a video interview when meeting with the manager or recruiter.

- A recruiter will never ask for personal information (i.e., Date of Birth, Tax ID) during the interview process.

- Any personal information needed for employment will only be collected once an offer letter or employment agreement is sent and signed. The collection

of any personal data is done through a secure, password-protected portal. - Under no circumstances will any IBKR Employee ask for personal information via text or email.