Using ScaleTrader for ForecastEx Contracts

PRODUCTS

Using ScaleTrader for ForecastEx Contracts

Providing Liquidity and Capturing Profit

ScaleTrader significantly enhances ForecastEx contract trading by allowing you to systematically provide liquidity while establishing predetermined profit targets through complement opinion orders. This approach reduces market impact while potentially improving execution prices and profit opportunities.

How it Works:

ScaleTrader can be configured to place Yes (or No) contract orders while simultaneously setting up profit-taking orders for the opposing No (or Yes) contracts. This comprehensive trading strategy

- Provides market liquidity through multiple price levels

- Establishes predefined profit targets

- Executes automatically without constant monitoring

Features for ForecastEx Contract Trading

- Liquidity Provision: By placing orders at multiple price points, you contribute to market depth. Forecast contracts is a growing opportunity as more clients choose to hedge their exposure to economic and climate risks.

- No Commission Structure: Take advantage of commission-free trading on forecast contracts.

- Automated Profit Taking: ScaleTrader automatically places opposite-side orders at your specified profit offset. Forecast contract markets are open 24/6.

- Risk Management: Scale your position gradually rather than entering with full size at a single point of time.

A Highly Configurable Tool

ScaleTrader uses price and size determinants that you specify to automatically scale your large volume order into smaller, incrementally priced components, and submits them as limit orders.

In addition, you can set a "scale offset" amount that ScaleTrader uses to submit opposite-side profit taking orders against your original order components. This allows position traders to pre-define the minimum amount of profitability acceptable for exiting a position.

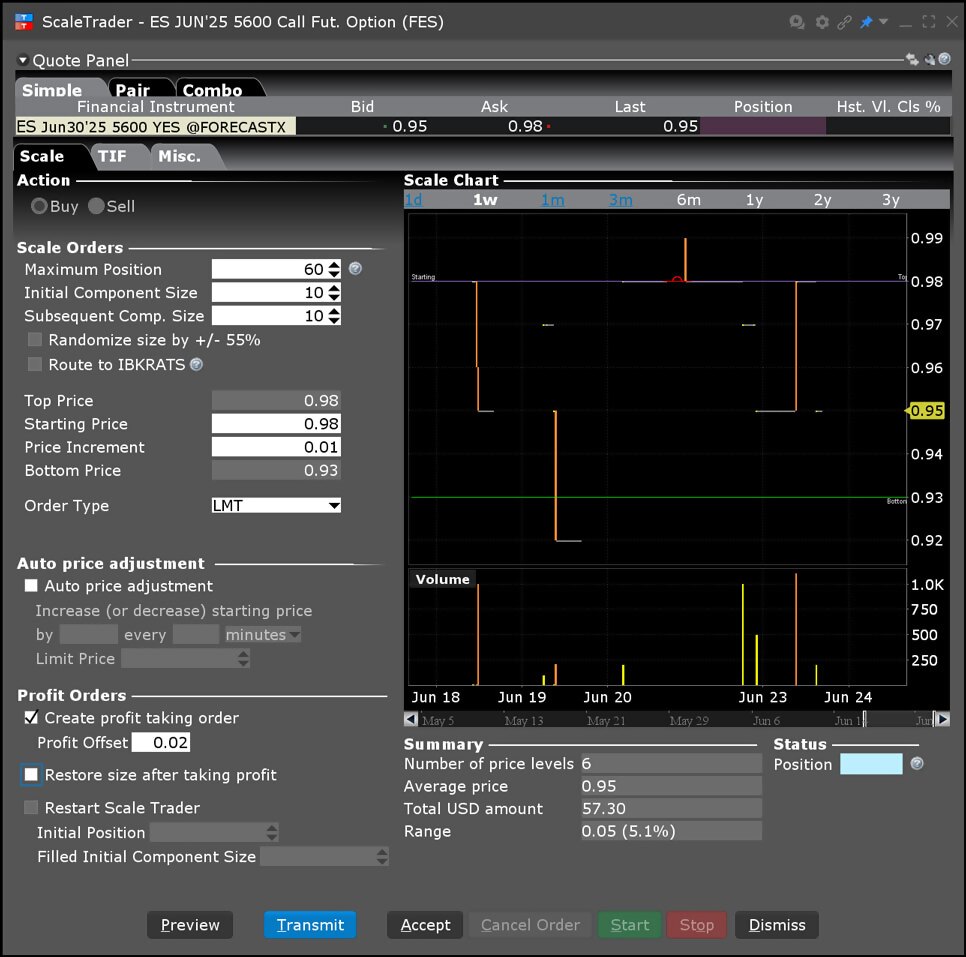

Configurable field and preset values include:

- Maximum Position: 60

- Initial Component Size: 10

- Subsequent Component Size: 10

- Price Range: From 0.93 (Bottom) to 0.98 (Top)

- Starting Price: 0.98

- Price Increment: 0.01

- Profit Offset: 0.02

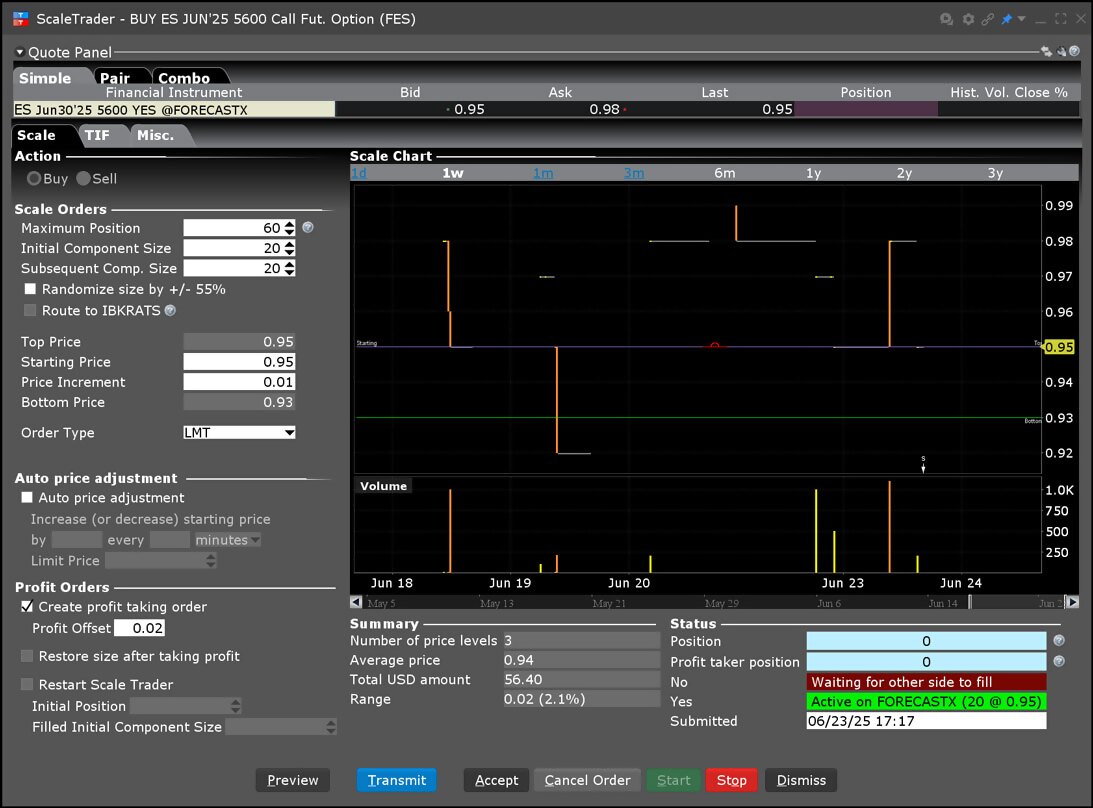

- Easily preview, start and stop strategies.

Progress Monitoring

The Scale Progress window tracks:

- Number of price levels (6)

- Average price (0.95)

- Price range covered (0.05 or 5.1%)

- Active orders on both sides (Yes and No contracts) once algo started

If prices move and a component of the order becomes unmarketable, the entire order waits until the component price becomes marketable.

The tool is available through our award-winning Trader Workstation (TWS).

USER GUIDES

Get Started with ScaleTrader

For more information on ScaleTrader, select your trading platform.

Disclosures

- The projections or other information generated by ScaleTrader regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

- Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

- Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

- Futures, event contracts and forecast contracts are not suitable for all investors. Before trading these products, please read the CFTC Risk Disclosure. For a copy visit our Warnings and Disclosures page.