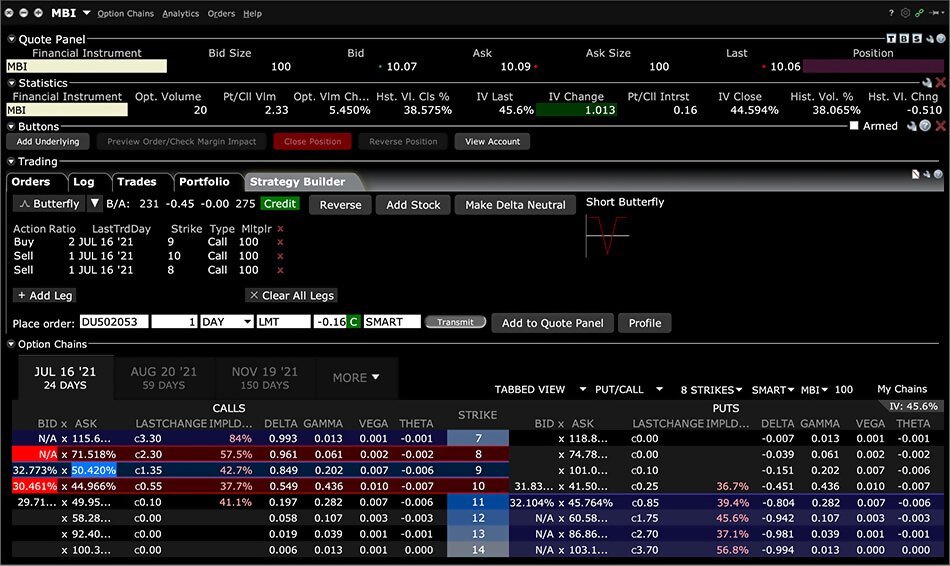

OptionTrader for Option Trading

OptionTrader is a robust trading tool that lets you view and trade options on an underlying.

OptionTrader displays market data for the underlying, allows you to create and manage options orders including combination orders, and provides the most complete view of available option chains, all in a single screen.

TWS OptionTrader offers traders the following benefits:

- Configurable format.

- Quick click order entry.

- Manage options orders on a single screen.

- Display Implied Volatility by contract.

- Calculate fair value of option contracts.

- View the Greek risk dimensions.

- See open interest on option chains.

- Color-coded values for quick glance information.

- Access Trader Workstation's other integrated options tools with a single click, including IB Risk Navigator, Options Analytics and Model Navigator.

Combo Tab

The OptionTrader Combo tab offers a quick, easy and accurate way to create and transmit a multi-leg combo order in as few as three mouse clicks.

The Combo tab lets Traders:

- Monitor price variations of the underlying in the Quote panel.

- View all available chains or filter for specific contracts. Option chains are organized by strike and expiry, with calls on the left and puts on the right.

- Use the Statistics panel to view open interest, volatility and volume changes, and other option-related statistics.

- Configure the data displayed by adding or removing columns for calculated model prices, implied volatilities, open interest and the Greeks.

- Trade in terms of volatility rather than option premium prices.

- Submit Delta Neutral trades, for which the required stock position is automatically calculated to hedge an option's delta risk.

- Create multiple pages for different underlying securities.

- Add "Display size" to work large orders on an iceberg basis.

USER GUIDES

Get Started with OptionTrader

For more information on using OptionTrader, select your trading platform.