Bonds Marketplace

PRODUCTS

The Bond Marketplace has a Vast Selection of Global Fixed Income Securities

The IBKR Advantage

- No mark-ups or built in spreads with low, transparent commissions

- Vast universe of over 1 million bonds globally

- Trade US Treasuries around the clock five days per week

- Use our Bond Search tool to compare available yields

- Overnight trading hours available for US Treasuries, European Government Bonds (EGBs) and UK Gilts

- Trade directly with other IBKR clients

- Rated Best Online Brokers for Bonds by Benzinga

No Mark Ups or Built-in Spreads

At IBKR, bond trades are executed without hidden mark-ups or built-in spreads. By removing embedded fees, traders benefit from clearer price discovery, tighter bid-ask spreads, and improved strategy performance, which are all essential in a market where every basis point counts.

Bond Commissions:

- Treasury bills, notes and bonds: 0.2 bps for the first USD 1 million

of face value, plus 0.01 bps for face value above USD 1 million - Corporate bonds: 10 bps for the first USD 10,000 of face value,

plus 2.5 bps for face value above USD 10,000 - Municipal bonds: 5 bps for the first USD 10,000 of face value,

plus 1.25 bps for face value above USD 10,000

Greater Breadth = Greater Opportunity

Access to a broad and diverse bond universe is essential for fixed income traders seeking better execution, flexibility, and performance. IBKR offers direct access to over 1 million bonds, supporting enhanced price discovery, greater liquidity, and a wide range of trading strategies such as curve trades, credit spreads, tax-aware investing, and global diversification. With transparent pricing and independence from dealer inventory constraints, traders can build more precise and customized portfolios that align with specific yield and risk objectives.

Available instruments include:

- A full universe of US government securities

- Corporate bonds

- Municipal securities

- CDs, and non-US sovereign bonds

- Fixed-income futures and fixed-income options

Nearly 24 Hour Access to Global Bond Markets

Trade US Treasuries, EGBs and UK Gilts up to 22 hours a day, five days a week. Swiftly respond to market-moving news and economic events as they occur, regardless of time and location.

Daily trading hours are 8:00 pm US Eastern Time (ET) to 5:00 pm ET. Please note that from November to early March are 7:00 pm to 5:00 pm ET.

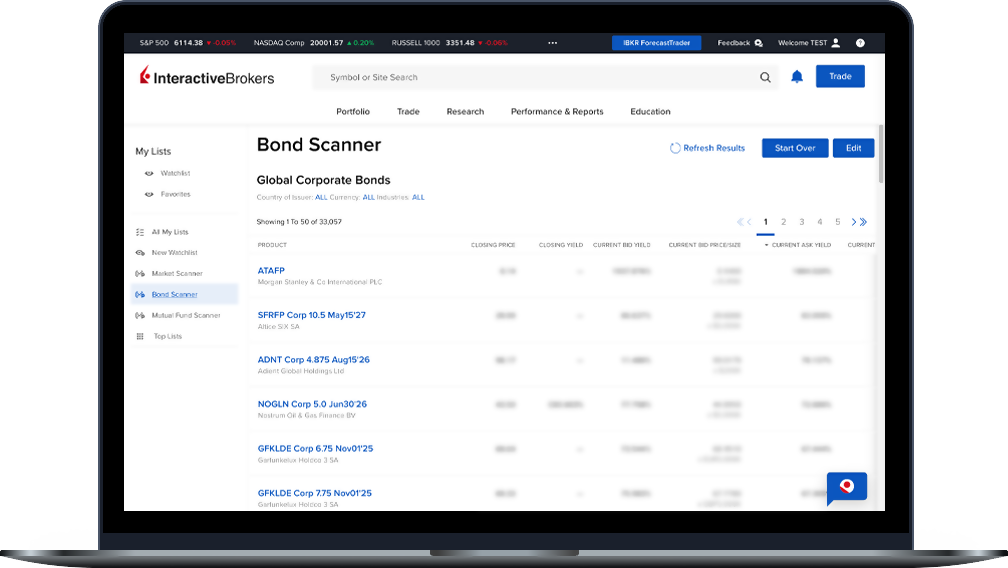

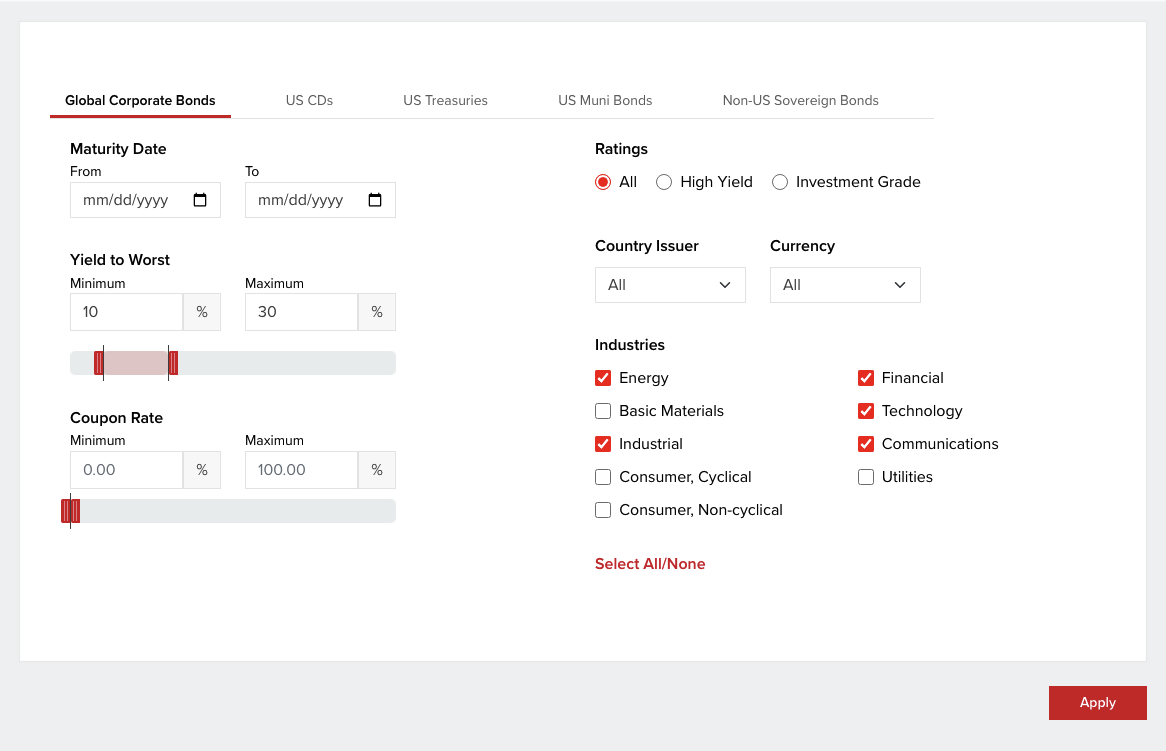

Discover Better Bond Pricing with Our Bond Search Tool

Put our transparent pricing and deep market access to the test. Use the Bond Search Tool to compare available yields across a vast universe of over 1 million bonds, including U.S. Treasuries, corporate bonds, municipal securities, and more.

Search by maturity, yield, credit quality, and other key criteria. You can also compare IBKR's bond prices and commissions directly with quotes from other brokers and see how much you could save with our low, fully transparent pricing and no hidden mark-ups.

For corporate bonds, simply enter your desired maturity range and click View Results. Sort your results instantly by clicking on the Yield or Maturity column headers.

Client-to-Client Bond Trading

If two IBKR clients on opposite sides of a trade want to trade the same bond at the same price, we cross the trade internally. By removing intermediaries, clients avoid hidden fees and negotiate better terms, providing for greater control over your trades. Client-to-Client trading also opens access to unique bonds and larger block sizes, helping you seize opportunities that may not be available through intermediaries.

What Is a Bond?

A bond is a type of debt security issued by governments, corporations, or other organizations to raise capital. When you purchase a bond, you are effectively lending money to the issuer in exchange for regular interest payments (called coupons) and the return of the bond’s face value (principal) when the bond matures.

Primary Market

In the primary market, bonds are sold directly by the issuer to investors for the first time. This is when the issuer raises funds for projects or operations. Buying bonds in the primary market means your money goes directly to the issuer.

Secondary Market

After bonds are issued, they trade in the secondary market, where investors buy and sell bonds among themselves. In this market, you are purchasing the right to receive the issuer’s future interest payments and principal repayment. Prices in the secondary market fluctuate based on factors such as interest rates, credit quality, and market demand, so your return depends on the bond’s yield and market price.

Understanding Bond Types and Structures

Bonds are typically categorized by issuer because different types of organizations raise capital for different purposes, and each carries its own level of credit risk and return potential. Here are the main types of bond issuers:

- Government bonds: Issued by national governments to fund public spending and national debt; generally considered low risk.

- Municipal (Local/Sub-sovereign) bonds: Issued by states, cities, or local governments to finance public projects such as schools, roads, or utilities.

- Corporate bonds: Issued by companies to raise capital for business operations, expansion, or refinancing existing debt.

- Government agency bonds: Issued by government-sponsored entities or agencies to support specific sectors like housing or agriculture.

- Supranational bonds: Issued by international organizations such as the World Bank or European Investment Bank to fund global development and cooperation initiatives.

Bonds vary by structure to meet the diverse needs of investors and issuers, offering different combinations of risk, return, flexibility, and payment terms. Here are some common bond structures:

- Fixed-rate bonds: Pay a consistent interest rate throughout the term of the bond.

- Floating-rate bonds: Interest payments adjust periodically based on a benchmark rate such as LIBOR or SOFR.

- Zero-coupon bonds: Sold at a discount to the bonds face value, which pays no interest. Investor will receive a single payment at the time of maturity, with the difference between the discounted purchase price and the face value representing the total interest earned.

- Convertible bonds: Allows the bondholder to convert the bond into a predetermined number of shares of the issuer's common stock at a specified conversion price.

- Callable bonds: Can be redeemed by the issuer before maturity, typically after a specified date, allowing the issuer to refinance if interest rates fall.

- Puttable bonds: Allow the bondholder to demand early repayment under certain conditions, providing additional flexibility in a rising rate environment.

The Role of Credit Ratings in Bonds

Credit ratings assess the creditworthiness of bond issuers and the likelihood that they will meet their debt obligations of paying interest and repaying principal on time. Ratings are assigned by independent agencies like Moody’s, Standard & Poor’s, and Fitch.

Investment Grade: Bonds rated BBB- (S&P/Fitch) or Baa3 (Moody’s) and above are considered investment grade. These bonds carry lower risk and typically offer lower yields because the issuer is seen as financially stable.

High Yield (Junk Bonds): Bonds rated below investment grade carry higher credit risk. They offer higher yields to compensate investors for the increased chance of default.

Credit ratings influence a bond’s interest rate, market price, and investor demand. They help investors gauge risk and make informed decisions about which bonds align with their risk tolerance and investment goals.

Key Bond Terms to Know

- Face Value (Par Value): The amount the bond issuer agrees to repay at maturity, usually $1,000 per bond.

- Coupon: The periodic interest payment the bondholder receives, typically expressed as a percentage of face value.

- Maturity: The date when the bond’s principal is repaid to the investor.

- Yield: The effective return on the bond, which can be current yield (coupon divided by price) or yield to maturity (total return if held to maturity).

- Yield to Maturity: The total annual return an investor can expect to earn if a bond is held until it matures, assuming all interest payments are made on time and reinvested at the same rate.

- Yield to Worst: The lowest possible yield an investor could receive if the bond is called, put, or otherwise retired before maturity, assuming no default.

- Coupon Rate: The fixed interest rate that determines the coupon payment.

- Call Provision: A feature allowing the issuer to repay the bond before maturity, usually at a premium.

- Duration: A measure of a bond’s sensitivity to changes in interest rates; longer duration means higher sensitivity.

- Credit Rating: An assessment of the issuer’s credit risk by rating agencies.

- Spread: The difference in yield between a bond and a benchmark (often government bonds), reflecting credit risk or liquidity differences.

- Bid-Ask Spread: The difference between the price a buyer is willing to pay and the price a seller seeks, indicating liquidity.

- Accrued Interest: Interest that has accumulated since the last coupon payment but has not yet been paid.

How to Buy Bonds

If you're a self-directed investor looking to add bonds to your portfolio, you can do so through most online brokerage accounts. Bonds can provide steady income, help diversify your holdings and reduce overall portfolio risk.

To begin, look for a broker such as Interactive Brokers that offering access to a wide selection of bonds, including U.S. Treasuries, municipal bonds, corporate bonds, and CDs. The broker should provide transparent pricing, low commissions, and good bond search tools.

Once you’ve found a bond that fits your strategy, enter your order online. You’ll typically choose the face value (or number of bonds) and review the total cost, which includes any commission or markup.

Why Trade Bonds?

Bonds can offer investors several benefits, such as:

- Steady income through regular interest payments

- Capital preservation when held to maturity

- Diversification for reducing overall portfolio risk

- Lower volatility than stocks in many cases

- Tax advantages with municipal bonds (often tax-free at the federal level)

- Predictable returns when held to maturity

However, investing in bonds may come with risks, such as:

- Interest rate risk: Bond prices fall when interest rates rise

- Credit risk: The issuer may default on payments

- Inflation risk: Rising prices can erode purchasing power

- Liquidity risk: Some bonds may be hard to sell quickly at a fair price

- Call risk: Callable bonds may be repaid early, limiting income potential

- Reinvestment risk: Future interest payments may have to be reinvested at lower rates

Interactive Brokers’ Education and Resources for Bonds

Traders' Academy

Traders’ Academy by Interactive Brokers provides complimentary resources to educate you on bonds, including a broad selection of courses to help you make more informed investment decisions about U.S. Treasuries, U.S. corporate bonds, U.S. municipal bonds, and the Eurodollar markets.

IBKR Webinars

Interactive Brokers regularly hosts webinars on bonds-related topics. If you would like to participate in an upcoming webinar or review a recently completed webinar, visit IBKR Campus.

Traders' Insight

Interactive Brokers Traders’ Insight blog offers daily commentary about bonds, as well as commentary and analysis from nearly 100 industry pros, including both IBKR's Chief Strategist and Senior Analyst.

USER GUIDES

Get Started with the Bond Search Tool

For more information on the Bond Search Tool, select your trading platform.

Start trading like a professional today!

Open AccountInteractive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and Member - Canadian Investor Protection Fund. Know Your Advisor: View the CIRO AdvisorReport. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities or derivatives. Our registered office is located at 1800 McGill College Avenue, Suite 2106, Montreal, Quebec, H3A 3J6, Canada.

Know Your Advisor: View the CIRO AdvisorReport