Option Strategy Lab

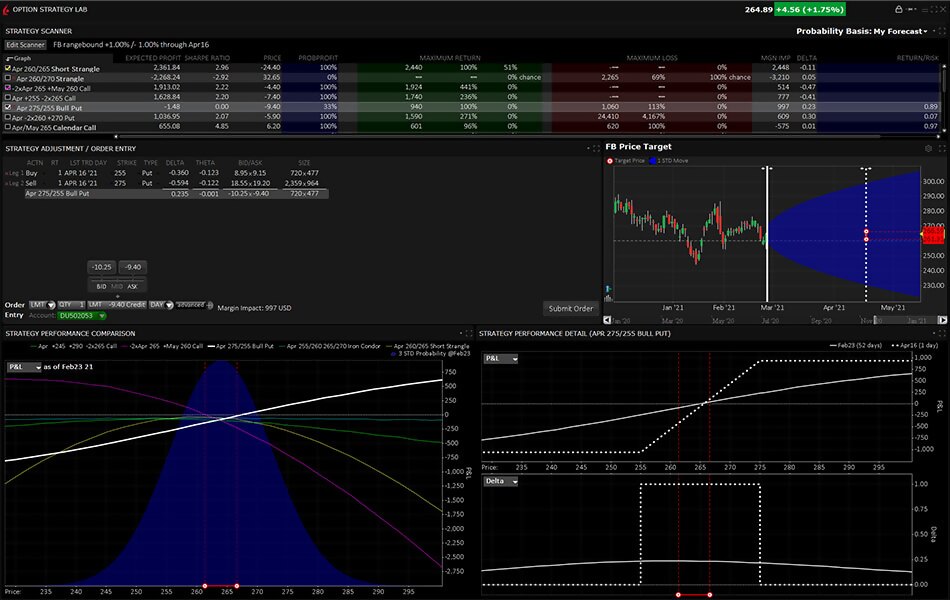

Create and submit simple and complex multi-leg option orders that are based on your price or volatility forecast using the Option Strategy Lab.

Option Strategy Lab offers traders the following benefits:

- Enter your own price or volatility forecast on an underlying to generate a list of strategies.

- Filter results by premium, delta, strike and/or expiry.

- For each strategy, see the potential profit and loss and risk/return ratio in the scanner results.

- Compare the P&L of up to five strategies at one time in the Performance Comparison chart.

- See the P&L performance of the selected strategy up close in the Performance Detail chart.

- Modify leg details and order parameters and submit an order directly from the lab.

USER GUIDES

Get Started with the Option Strategy Lab

For more information on using the Option Strategy Lab, select your trading platform.