TWS Release Notes

For You Notifications

Whether it's been two days or two weeks since you last logged in, For You Notifications get you up to speed quickly by sorting through changes then debriefing you on the most important events and updates in your account since your last login. See filled orders and open orders that might benefit from your attention, dividends collected and the top contributing stocks, interest earned and important options activity, to name just a few. For each listed event, tap More to get additional details and dive deeper, with related tools put right at your fingertips.

Available across all platforms, For You Notifications are custom-generated for your account, then filtered and weighted to ensure that only the most potentially impactful events make the list.

Continuous Sorting for Portfolio Columns

Many columns in your TWS Portfolio now support "continuous sorting." This feature automatically re-sorts positions in your Portfolio when an event occurs in your account that changes values in your portfolio, resulting in the need to re-apply the sort order. For example, if you elect to sort your Portfolio continuously by Position (either ascending or descending), when you buy or sell an asset the sort is automatically reapplied to your portfolio to keep the selected sort order up-to-date.

To enable Continuous Sorting for a supported Portfolio field, right-click the column header, select "Sort By" and then choose from the "Continuous Sort" methods available. Clicking the column again will disable Continuous Sort but will allow you to toggle through the sort order (ascending, descending and none) for a one-time sort. One-time sort does not update automatically as the Portfolio changes.

Fields that currently support Continuous Sort are:

- Market Value

- % of Market Value

- Daily PnL

- Unrealized PnL

- Realized PnL

- Avg Price

- Position

To add a field to your Portfolio, hold your mouse over an existing column name to show the insert/remove selections. Click Insert Column. Choose from the categories and command list to add a field to the window.

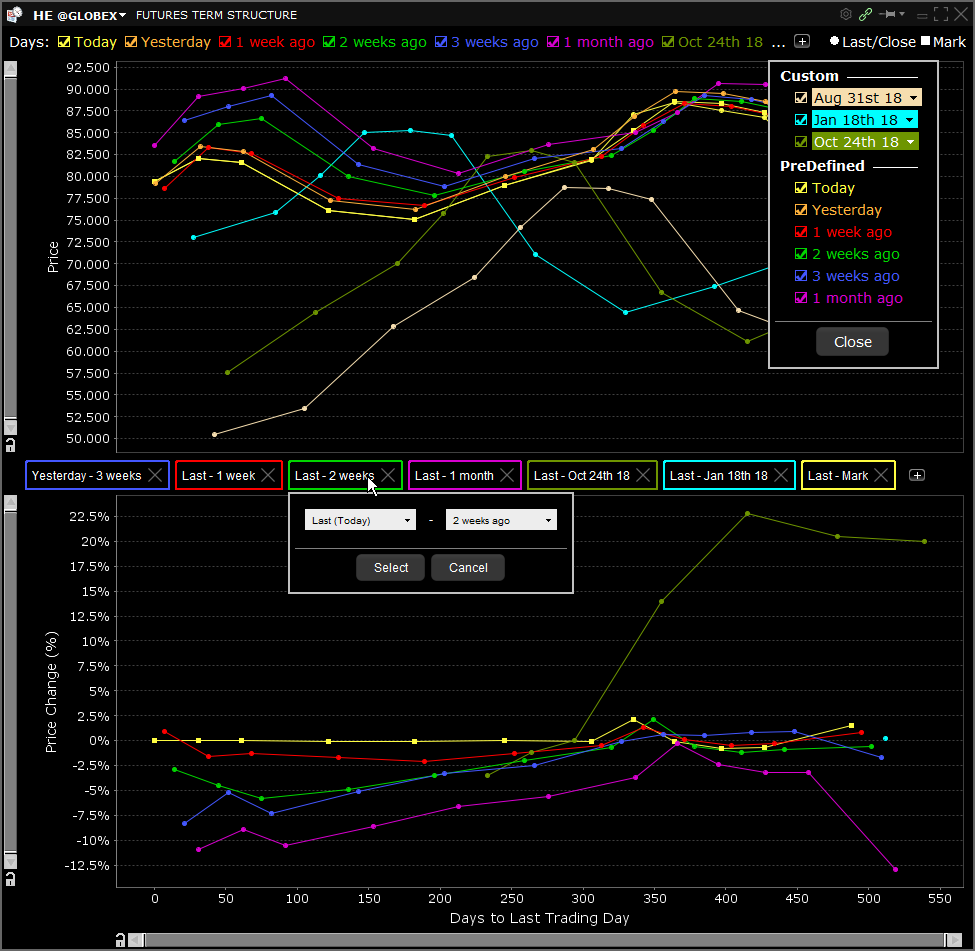

Futures Term Structure: Difference Plot Custom Curves

A new flexible series selector lets you easily add, remove or modify what series are shown on the difference plot and how each is calculated with a single click in the displayed configuration panel. Between the Price and the Difference Plot you can see labels for the currently selected difference definitions. Their border colors are the same as their difference series color. TWS updates the default series for the difference plot based on your configuration as you add or remove dates to the price plot or change your configuration.

- You can change the difference series definition by clicking on the label. It will show a small popup where you can select the days (all the series that are selected for the Price Plot). Once you select the days pair it will change the currently selected definition to the new one (unless you selected a pair which is already selected, in this case it will just remove the edited definition)

- You can remove a definition and its series by clicking the X inside the color border.

- You can add a new definition by clicking on the + button and using the same popup as for the editing/changing.

- When you remove a date from the top check boxes it will remove all definitions that contained this date.

- When you select a new date the window will generate the appropriate new definition depending on the configuration

The definitions you specify here will be kept for a newly opened Futures Term Structure window or when you select a new future, even after you log out and restart TWS.

To access the Futures Term Structure tool, select a futures contract and use the right-click menu to select Charts and then Term Structure.

NOTE: If you don't see this selection, use the down arrow to expand the selection list.

IBot Provides Supplemental Information

We continue to enrich the IBot user experience by offering supplemental articles and information from external sources, like Wikipedia and Investopedia. These third-party additions are clearly marked in IBot's search results.

Consolidated Watchlists & Scanners

Coming Soon: We have merged our Watchlist and Scanner functionality into a single tool to make the interface more intuitive. Both features result in a list of financial instruments, with the major difference being the method by which they are compiled. Moving forward, the Watchlist page will include both static Watchlists and dynamic Scanners. And because these lists are saved to the Cloud, you can see the same lists across all your trading platforms.

Watch for this feature to be released soon to IBKR Mobile, Desktop TWS, and Client Portal.