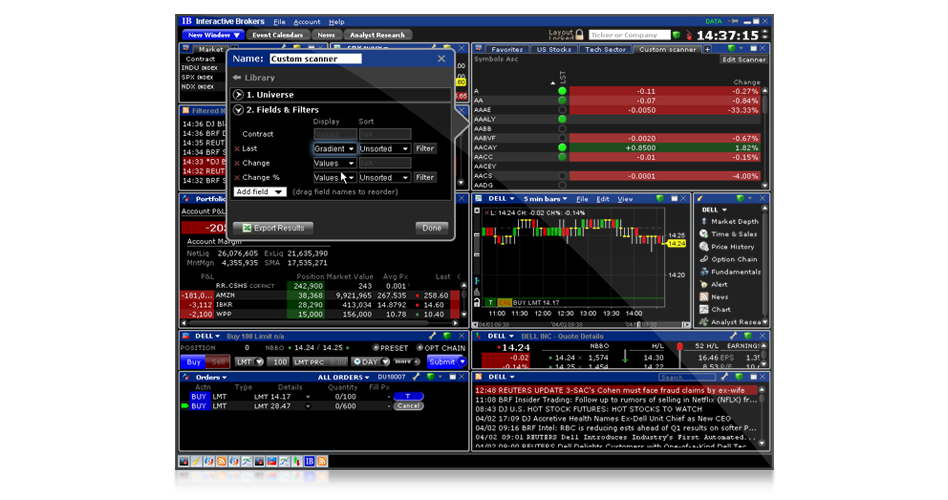

TWS Market Scanners

The TWS Market Scanners allow you to quickly and easily scan global markets for the top performing instruments, including stocks, options, futures, bonds, indexes and more, in numerous categories.

Customize your scan with any combination of user-specified search criteria such as instrument type, market center(s), price and volume constraints, sector and industry, and more.

- Scan multiple products around the world - Scan for top instruments on US options, stocks, futures, indexes, corporate bonds, EFPs and SBLs; America non-US stocks and futures; and Europe and Asia stocks, futures and indexes.

- Choose from popular scan parameters - TWS provides many of the most popular and useful scanners, including: High Dividend Yield, Top % Gainers and Losers, Most Active, Hot by Price and Volume, Top Trade Rate, Highest and Lowest Option Implied Volatility, 13-, 26- and 52-week High and Low, and many more.

- Save your favorites - You can create a custom scan that you check each day by simply leaving the defined scan parameters on a trading page, which is automatically named using the scanner title. You can create as many "scanner" trading pages as you need.

- Create custom scans - Variables, filters and parameters allow you to create unique, completely customized scans. For example, you may want to find the top ten most active US stocks with a price of USD 30.00 or lower, but only in the Real Estate industry. Or, search for all exchange-listed US Corporate Bonds with an A1 Moody's rating or better. The search definitions are practically limitless.

- Redefine a scan in two clicks - It's simple to modify and re-run your scan. Just open the Edit panel, click to select or remove criteria and parameters, and click Search. TWS Market Scanner does the rest!

- Run scans after market hours - Use TWS Market Scanners (with the exception of bond and EFP scanners) after trading has stopped on evenings and weekends. After-hour scanners use data from the previous close to provide a static snapshot as of the market's close, and after-hours scanners are identified by a gray background.

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking here.

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and Member - Canadian Investor Protection Fund. Know Your Advisor: View the CIRO AdvisorReport. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities or derivatives. Our registered office is located at 1800 McGill College Avenue, Suite 2106, Montreal, Quebec, H3A 3J6, Canada.

Know Your Advisor: View the CIRO AdvisorReport