The Smarter Way to Manage Your Money

IB UNIVERSAL ACCOUNT

The Smarter Way to Manage Your Money

Unlock Your Financial Potential with an All-in-One Solution

Do more with your money in an IBKR account!

Earn Interest

Earn interest up to CAD 1.678 on instantly available cash balances.

View Interest DetailsBorrow

Borrow funds at CAD 3.678 or less, with no monthly minimum payments or late fees.1

View Margin DetailsLow Cost

Low commissions with no added spreads, ticket charges, platform fees, or account minimums.

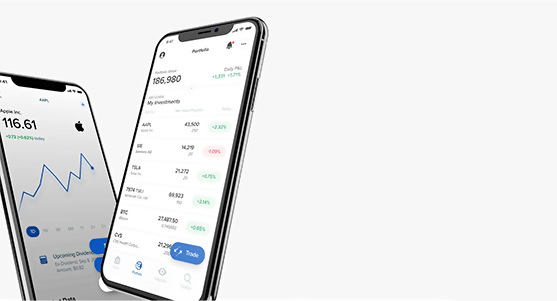

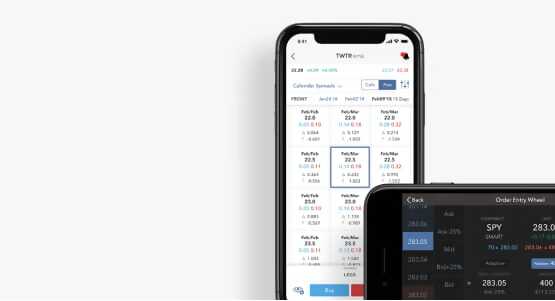

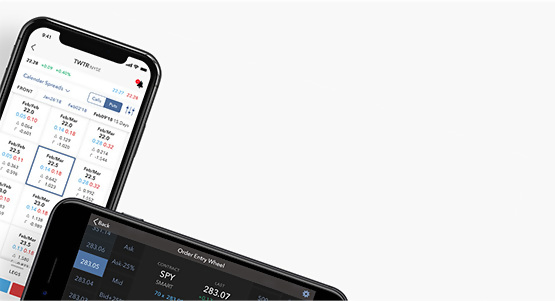

View Cost DetailsInvest

Invest globally in stocks, options, futures, currencies, bonds and more.

View Investment ProductsStrength & Security

IBKR is a broker you can trust, and our strong financial position and conservative business management protect IBKR and our clients.

Our Strength and SecurityOpen Your Account Today!

Download an app and sign up, or sign up online

Disclosures

- Annual Percentage Rate (APR) on CAD margin loan balances. Actual benchmark rates vary. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. For additional information on margin loan rates, visit our margin rates page.