股票交易:在线交易股票

产品

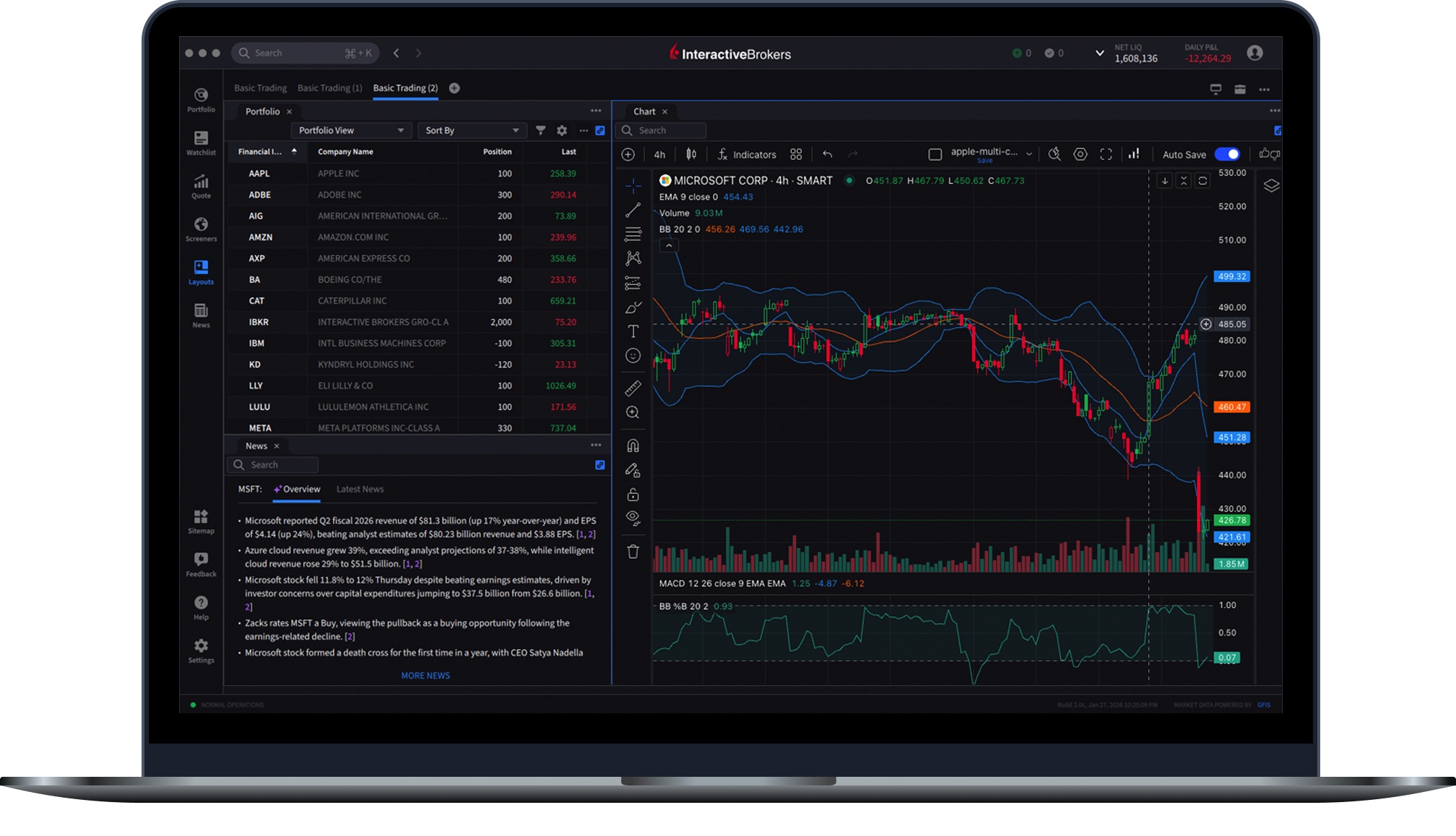

在一个界面上交易全球股票

IBKR的优势

- 佣金低廉,且无额外价差、委托单费用、平台费用或账户最低资金要求

- 在全球90多个市场中心交易股票

- 业内最低的融资利率

- 专业的交易平台、移动应用、委托单类型和工具

- 公开透明的可做空股票库存与价格

- 小数股交易,让您投资高股价的公司

- 将您全款买入的股票借给其他交易者,从而获得额外收益

“零佣金”并不等同于“免费”

与其他券商的客户相比,盈透证券的客户节省了大量成本

Comparison of US Stock Trading Costs for Canadian Residents

The comparison to other providers is based on the rates published on their websites as of February 10, 2025 for deals in US stocks. Deals in U.S. listed ETFs and U.S. dollar-traded Canadian ETFs not considered. Providers' account types used for this illustration are what we consider default standard tier. 1

See Notes and Disclaimers for complete information.

| Total Trade Cost with Currency Conversion2,3 | Advertised Rates | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Broker | 50 shares CAD 2,000 |

100 shares CAD 5,000 |

200 shares CAD 10,000 |

US Stock Commission |

FX Conversion Fee4,5 |

||||||||||||||||||||||||

| Interactive Brokers | USD 2.527 | USD 2.707 | USD 3.407 | USD 0.00356 | USD 2.006 | ||||||||||||||||||||||||

| WealthSimple | USD 23.588 | USD 58.958 | USD 58.958 | USD 0.00 | 1.50%8 | ||||||||||||||||||||||||

| Questrade | USD 23.589 | USD 58.959 | USD 117.909 | USD 0.0011 | 1.50%12 | ||||||||||||||||||||||||

| BMO Investorline | USD 35.1010 | USD 72.8310 | USD 135.7110 | USD 9.95 | 1.60%13 | ||||||||||||||||||||||||

|

Cannot be determined because we have not been able to locate the foreign exchange conversion fee on the pricing pages of the public website of these providers. |

|

|||||||||||||||||||||||||||

- The comparison is based on our understanding of the other providers' published rates available on their websites as of February 10, 2025. The comparison is also based on the quantity of shares comprising the trade sizes in the three scenarios displayed above. WARNING - The comparison of brokerage fees that are set under different pricing models may vary based on the quantity of shares comprising the trade and in some cases, a fixed or "per-trade" fee pricing model (as used by other providers) can, in fact, be more competitive that Interactive Brokers' variable or "per-share" pricing model which is more competitive when the trade size is comprised of a smaller quantity of shares. For example, our commission on a trade size of USD 20 000 will be USD 1.75, when the trade is for 500 shares at USD 40 but will be USD 17.50 when the trade is for 5000 shares at USD 4.00 ([0.0035 x 500 shares = USD 1.75] and [0.0035 x 5000 shares = USD 17.50]).

- "Total Trade Cost with Currency Conversion" considers stock execution commission (when applicable) and fx conversion fee charged by the providers. In case of IBKR, we have additionally included regulatory, clearing and exchange fees that are passed through to the client on a transactional basis.

- Assuming account initially funded with, and holding, Canadian currency (CAD). This table shows three different trade sizes using different quantity of shares traded on a U.S. market. For comparison purposes, "Total Trade Cost with Currency Conversion" is indicated in USD. The USD/CAD FX exchange rate used in the comparison table is 1.2722, which conversely represents a rate of 0.7860 CAD/USD (used for calculation purposes).

- This conversion fee is the revenue earned by the broker on each currency conversion transaction. It is an additional fee to the commission or other fees applicable to the stock transaction. For the purpose of this presentation the foreign exchange conversion fee is expressed as a percentage of the total value of the currency being converted. For the other providers in this table, this fee is typically included in the total foreign exchange rate applied to the conversion without charging a separate transaction-based "commission". Although the total foreign exchange rate applied to the conversion is usually disclosed to clients at the time of the currency conversion transaction, the conversion fee applied to the conversion is rarely disclosed separately to the client. In the interest of providing a transparent pricing structure, IBKR does not mark up its FX quotes and therefore does not include a conversion fee in the total foreign exchange rate applied to the conversion. Instead IBKR passes through the prices that it receives from the global interbank market and charges a separate FX "commission" which is clearly disclosed to clients at the time of the currency conversion.

- Some firms may not allow you to hold U.S. dollars in your brokerage account and will subject you to forced currency conversion fees on each transaction.

- IBKR tiered stock commissions of USD 0.0035 per share (minimum of USD 0.35). Other providers' stock commissions are usually set at a dollar amount per trade basis. IBKR's FX "commission" of USD 2.00 per order (0.20 basis point x trade value, with a minimum of USD 2.00 per order). Note- One basis point = 1/100 of 1%, so 0.20 basis point = 0.002%

- IBKR Total Trade Cost with Currency Conversion = IBKR Tiered Stock Commissions + Exchange, Regulatory, Clearing Fees + FX "Commission".

USD 2.52 = 0.35 + 0.17 + 2.00; USD 2.70 = 0.35 + 0.35 + 2.00; USD 3.40 = 0.70 + 0.70 + 2.00 - Wealthsimple FX Conversion fee is 1.5% for amounts between $0-$9,999.99 and 0.75% for amounts between $10,000-$24,999.99

Wealthsimple Total Trade Cost with Currency Conversion = Zero Stock Commission + FX Conversion Fee.

USD 23.58 = 0.00 + (CAD 2000 x 0.7860 x 0.0150); USD 58.95 = 0.00 + (CAD 5000 x 0.7860 x 0.0150); USD 58.95 = 0.00 + (CAD 10,000 x 0.7860 x 0.0075) - Questrade Total Trade Cost with Currency Conversion = Stock Commission + FX Conversion Fee.

USD 23.58 =0.00 + (CAD 2000 x 0.7860 x 0.0150); USD 58.95= 0.00 + (CAD 5000 x 0.7860 x 0.0150); USD 117.90 = 0.00 + (CAD 10,000 x 0.7860 x 0.0150) - BMO Investorline Total Trade Cost with Currency Conversion = Stock Commission + FX Conversion Fee.

USD 35.10 = 9.95 + (CAD 2000 x 0.7860 x 0.0160); USD 72.83 = 9.95 + (CAD 5000 x 0.7860 x 0.0160); USD 135.71 = 9.95 + (CAD 10,000 x 0.7860 x 0.0160) - Exchange and ECN fees may apply.

- As published on https://www.questrade.com/pricing/self-directed-commissions-plans-fees#fees

- For transaction size less than $25,000 CAD.

- The Securities and Exchange Commission (SEC) charges a fee for every executed sell order on any American exchange. Desjardins Online Brokerage reserves the right to limit the number of intra-session trades on the same security.

- Trades must have been made through National Bank Discount Brokerage's electronic solutions.

- We have not been able to locate on the pricing pages of the public website of these providers the foreign exchange conversion fee component of the foreign exchange conversion rate applied to a specific currency conversion transaction.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up, and you may get back less than you invest.

降低成本,最大化回报1

交易技术

- 免费访问全部IBKR交易平台

- 免费获得所有美股的实时流数据

- IB智能传递(SmartRoutingSM)

- IBKR API

其它计划优势

- 一般投资账户无最低要求

- 无闲置费

- 无额外价差、委托单费用或平台费用

- 无定期费用

IB智能传递(SmartRoutingSM)通过在各大交易所与暗池中搜索客户下单时公司股票、期权以及组合的最优可交易价格,从而助客户实现最佳价格执行。

专业的交易平台、多种委托单类型和丰富的工具

屡获殊荣的的强大交易平台和工具,助您管理您的投资组合。桌面电脑、移动应用和网页均支持。

见我们的交易平台100多种委托单类型、算法和工具——从限价单到算法交易复合委托单——帮助您达成任何交易策略。

见我们的委托单类型、算法和工具通过使用全套专业级交易工具,帮助您更好地做决策并管理您的投资组合。使用先进的市场扫描仪发现市场机会并使用风险漫游工具分析您的投资组合。

见我们的交易工具基本面探索器提供3万多家公司的全面的全球基础数据,每家公司可显示超过300个数据点,并由80多个新闻专线与报告的资源,提供来自TipRanks超过5500个分析师评级。

见我们的基本面探索器使您的投资与您最在乎的事情保持一致。使用“Impact控制面板”确保您的投资符合您的价值观,使用LSEG环境、社会和治理(ESG)评分作出不仅仅是基于财务因素考量的投资决策。

了解可持续投资通过借出全额支付的股票赚取额外收益

通过借出您全额支付的股票赚取额外收益。IBKR从您那里借入股票,然后将股票借给希望做空股票并愿意支付借券利息的交易者。在股票借出的每一天,您都会获得利息并且仍可以不受限制的交易您出借股票。

什么是股票?

股票代表在一家公司的所有权。当您购买一只股票,您便会成为股东并拥有发行股票的公司的一小部分。因此,您对其资产和收益拥有索赔权。

公司通常发行股票以筹集资金,用于支持增长、研发或运营,而无需承担债务。

股票的两种主要类型是普通股(通常为您提供投票权和潜在股息)和优先股(通常提供固定股息,并且在概率极低的清算情况下优先于普通股股东)。

您要怎样买股票?

您可以通过线上经纪账户(如盈透证券提供的账户)或通过财务顾问购买股票。如果您使用线上经纪账户,在您的账户获批和注资后,您便可通过经纪商平台下单买卖股票。

股票是在股票交易所进行买卖,例如纽约证券交易所(NYSE)、纳斯达克(NASDAQ)、伦敦证券交易所(LSE)、泛欧证券交易所(Euronext)或上海证券交易所。

股票的风险和报酬是什么?

股票价格可能非常波动,意味着您的股票价值可能在短时间内大幅上涨或下跌。股票投资不提供保证。如果股票价格低于您的买入价格且您赔本卖出,您可能会损失金钱。此外,您也可能因公司破产、盈利不佳或更广泛的市场因素而遭受损失,如行业或经济趋势、利率变化、地缘政治事件或投资者情绪。

然而,如果股票价格逐步上涨,您可能会从资本增值中受益,并从与股东分享利润的公司获得股息收入。股息可以提供稳定的收入来源,如果再投资,可能有助于提升您的长期回报。

盈透证券的股票教育与资源

今天就开始像专业人士一样交易!

开立账户Interactive Brokers Canada Inc.是 加拿大投资行业监管组织(CIRO) 和和加拿大投资人保护基金的成员。了解您的投资顾问:查看CIRO投资顾问报告。证券和衍生品的交易可能包含高风险,投资者应做好失去全部投资和进一步损失的风险准备。使用贷款来融资购买证券的风险远大于仅使用现金购买。如果您融资购买证券,即使您所购买证券的价值出现下跌,您仍有责任按照条款偿还贷款并支付利息。Interactive Brokers Canada Inc.是一家仅仅为客户执行委托单的交易商,不提供有关购买或出售任何证券或衍生品的投资建议或推荐。我们的注册办公室位于1800 McGill College Avenue, Suite 2106, Montreal, Quebec, H3A 3J6, Canada。

了解您的投资顾问:查看CIRO顾问报告